AI’s Greatest Moments: Celebrating Artificial Intelligence Appreciation Day

Discover the most remarkable achievements in artificial intelligence as we honor AI’s Greatest Moments on Artificial Intelligence Appreciation Day.

The Internet of Things is a revolutionary technology that has penetrated into most of the industries from agriculture to healthcare and more. Among many industries who have leveraged the power of IoT to stand out in the market insurance sector will receive the maximum benefits.

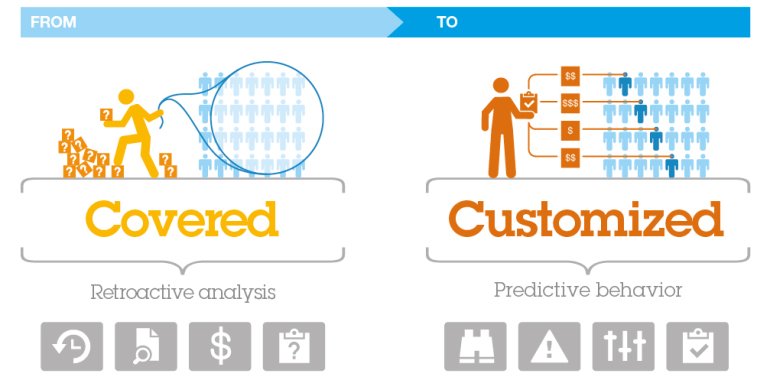

Until now, insurance companies were dependent on past experience, analytics and information gathered from applicants. Implementation of connected devices will allow insurance companies to get access to an immense amount of personal information to get a clear picture of clients

Image credit: autoconectadojooyca

How is the Internet of Things changing Insurance Industry Landscape

The insurance business is dependent on data and IoT provides an opportunity to huge volumes of data. It reveals real-time insights regarding policyholder behavior to better do the following tasks

The client will benefit in below areas

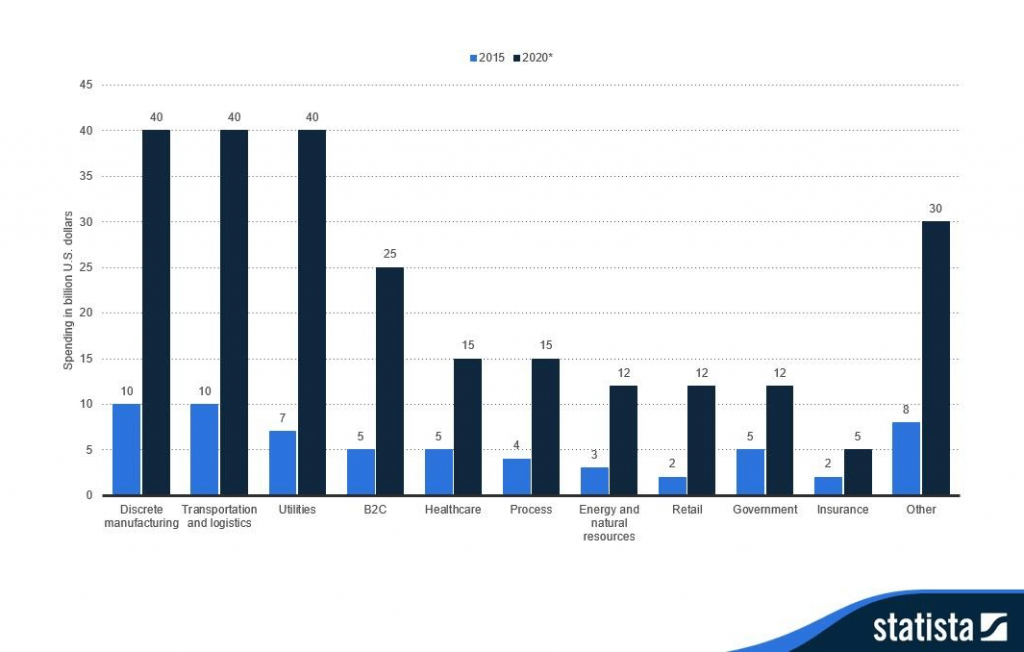

Statista predicts a significant increase in investment to implement IoT in the insurance industry from $2 billion in 2015 to $5 billion in 2020

Image credit: Statista

Sensors on Vehicles and Machines

Sensors will collect important data like distance traveled, speed and frequency of braking. The set up of diagnostic sensors will notify the user about any mishappening or a breakdown risk.

Environmental sensors

These sensors will be set up inside houses, offices, factories and other buildings to provide data about temperature, humidity, toxic fumes, mold, smoke or other hazardous conditions. These sensors are very useful when installed in drones and cameras to control environmental conditions and give useful data to various industries especially the agriculture industry.

Biometric sensors

They are the core of wearables technology which will monitor health, heartbeat, blood pressure, pulse, steps covered by the user and other health-related data. Insurance agents upon monitoring these data will be able to notify customers who are experiencing workload beyond the permissible limit. It will also be useful in predicting the heart attack and accordingly initiate preventive actions.

Geographic information systems (GIS)

Accurate information about various geophysical, topographical, climatological and hydrological factors. These insights will help insurance providers to better risk element associated with whether or seasonal variations which are determining factor in aircraft, shipping, sports, and agriculture sector.

Image credit:do not use – old developerworks account

The three main segments that are determined on integrating IoT devices are:

Basically, Clients are provided with intelligent devices for tracking the personal activities and about their property.

Auto insurers will use smart solutions to gather metrics from policy owners vehicles like data regarding speed, distance traveled, turning and braking patterns, time of day and much more.

This will benefit in form of lesser loss ratios, and increased profit margins

The health segment of insurance industry can equip customers with fitness tracking device to monitor customers activities and offer them lower premiums if they meet a specified goal. In this manner, wearables will provide the insurance company with valuable data that can be used to adjust rates more precisely for maximum profitability at the same time help customers to avoid diseases and injuries.

Home and property insurance companies will let customers to install connected devices that will warn about any potential danger like flood, fire or robbery well ahead. Drones will be used to calculate damages after a disaster.

Implementation of IoT in the insurance industry will face challenges in terms of data privacy and ownership and compatibility with existing devices yet it will transform insurance industry from he claims payer to a preventive risk adviser.

You may be interested in below posts:

Jul 16th, 2024

Discover the most remarkable achievements in artificial intelligence as we honor AI’s Greatest Moments on Artificial Intelligence Appreciation Day.

Jul 11th, 2024

Discover the best methods for adding your blogs to your GitHub profile. Enhance your visibility and engage more followers. Click for detailed guide.

Jun 18th, 2024

Learn about the groundbreaking features of iOS 18 and why it’s considered the most impressive update to date. Stay ahead with our detailed insights.